Financial Literacy Program

The University at Buffalo’s Financial Literacy Program is designed to help students understand the basics of money management.

Affording college may seem overwhelming at first. Learning the basic steps can help make the process easier.

- Complete the FAFSA each year before UB’s priority filing deadline of March 1. Use UB’s School Code – 002837.

- Undergraduate New York State residents should complete a New York State TAP application immediately after completing the FAFSA. Use UB’s TAP School Code – 1010.

- Check your UB email daily! We use your UB email to send you important notifications and request information as needed.

- Check your HUB To Do List often. Items listed in your To Do List may be required to process your aid.

- If you do not have enough financial aid to cover your charges, consider enrolling in the payment plan before applying for additional Federal Direct Parent or Graduate PLUS Loans or Private Loans.

- If you have any questions about your financial aid options, contact our office.

SUNY Smart Track is an online financial education program used to educate students on the basics of personal finance. You can take informative courses or read helpful blog posts on a number of topics that will help you with your finances.

SUNY Smart Track is an online financial education program used to educate students on the basics of personal finance. You can take informative courses or read helpful blog posts on a number of topics that will help you with your finances.

Individual courses cover the following topics:

- FAFSA (offered in English and Spanish)

- College and Money

- Loan Guidance

- Debt and Repayment

- Psychology of Money

- Foundations of Money (offered in English and Spanish)

- Earning Money

- Credit and Protecting your Money

- Spending and Borrowing

- Future of Your Money

Register for SUNY Smart Track

- Visit the SUNY Smart Track website.

- Select “Buffalo, University at” from the campus list.

- Create a username and password.

- Enter personal identification details (name, date of birth, etc.).

- Enter your person number in the Student ID field and select “How did you hear about SUNY Smart Track”.

- You will receive a registration confirmation email. You must click on the link provided in the email to finalize registration.

College is the perfect time to start thinking about credit. This may be the first time you have borrowed loans, or opened a credit card. It may be the first time you have lived alone and been responsible for your own expenses. If you take the time to responsibly build and maintain good credit now you will have a bright financial future.

Knowing what is included in your credit report and your credit score are essential to planning for your financial future. You can obtain your credit report for free once a year at Annual Credit Report.com.

Credit Score

It is now easier than ever to check your credit score. Many banks and credit card companies are providing FICO scores to their customers with their monthly statements. Check with your bank to see if this is available to you.

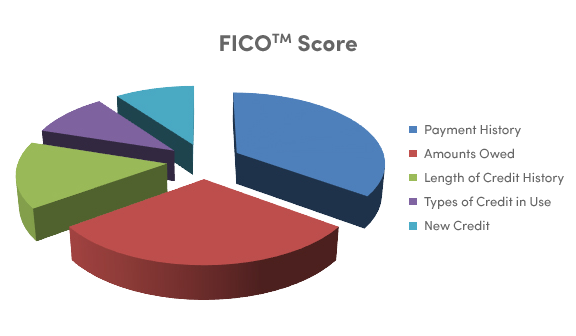

The most common credit score used is called a FICO Score. Your FICO score can range from 300-850 and is comprised of five categories.

- Payment History: 35% of your credit score is based on whether or not you’ve paid past credit accounts on time.

- Total Debt: 30% of your credit score looks at the total amount of debt you have.

- Length of Credit History: 15% of your credit score looks at the length of credit history. This includes how long your credit accounts have been established, how long it has been since you used certain accounts, how long specific credit accounts have been established, and the average age of your accounts.

- Type of Credit in Use: 10% of your credit score looks at your mix of credit cards, retail accounts, loans and mortgages.

- New Credit: 10% of your score looks at your new credit use. Opening several credit accounts in a short period of time can be interpreted to be an indication of risk.

Credit Report

Credit reports will include:

- Identifying information such as your Social Security Number, date of birth and employment information. This information is not used in credit scoring.

- Credit Accounts: lenders report on each account you have established with them. They report the type of account (auto loan, credit card, student loan etc.), the date you opened the account, your credit limit, or borrowed amount, your current balance and payment history.

- Credit Inquiries: any time you apply for a loan, you authorize your lender for ask for a copy of your credit report. Any inquiry within the last two years will appear on your credit report. One exception occurs when you are rate shopping. FICO score considers all inquiries within a 45 day period for a mortgage, and auto loan or a student loan as a single inquiry.

- Public Record and Collections: credit reports will collect information from state and county courts, including information bankruptcies, foreclosures, liens and financial judgments.

Visit the following websites or download one of the apps for your phone to help you maintain a good financial situation.

Websites

- Annual Credit Report.com: Obtain your credit report once a year for free.

- Federal Trade Commission: Obtain consumer information regarding identity theft, what to do if you are a victim and ways to protect your personal information.

- Hip2Save: Daily posts of money saving coupons and sales.

- Mint: See all of your balances and transactions together in one place. (Also available as an app for iOS and Android).

Apps

Information is subject to change without notice due to changes in federal, state and/or institutional rules and regulations. Students must complete a FAFSA every year. Students must be making satisfactory academic progress to continue to receive financial aid.